Irs Fixed Asset Useful Life Table

3-year property race horses rent-to-own property. Capitalized cost includes all costs necessary to bring the asset to the form and location for its intended use such as amounts paid to vendors transportation handling and storage labor installation integration and other direct and.

Macrs Depreciation Tables How To Calculate

Posted on February 07 2015.

Irs fixed asset useful life table. Office furniture for example including desks chairs lamps and literature racks are assumed to have a useful life of seven years. According to IRS publication 945 chapter 4 httpswwwirsgovpublicationsp946ch04html Computers and peripheral equipment are classified as 5-year property and must be depreciated over that time span using IRS Form 4562. Includes depreciation for equipment and the estimated useful life of equipment and more.

Constructing a lessor irs asset useful table for people think of time each one year to calculate depreciation is the account. I know that Table ANKB can give the recent useful life. The original underlying asset will be the table.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168a of Capital Asset An asset including land structures equipment and intellectual property including software that has an estimated useful life of two or more years. Here are the nine classes and examples of the types of property they cover. If an observed item is not listed it should be assigned to the most closely related category.

EXPECTED USEFUL LIFE TABLE SITE SYSTEMS FAMILY ELDERLY ACTION REPLACE 50 long-lived systems CONSTR. Use this table to determine an assets class based on the assets activity type or description. Visit IRSgovForms to download current and prior-year forms instructions and publications.

While the car will probably run longer than that youre not likely to continue using that car for business purposes after the first five years. Demand that purchased the irs depreciation and cable testing equipment. 2016 Publication 946 - Internal Revenue Service.

2021 Daily Search Trends FeedbackDaily Search Trends Feedback. Each class is named for its useful lifetime. The IRS has divided every imaginable type of business property from race horses to tugboats into nine classes.

UNLESS NOTED Basketball Courts 15 25 Built Improvements playgroundssite furniture 20 20 Catch Basin 40 40 Cold Water and Sewer Lines 40 40 Compactors 15 15 DHWSupplyReturn 30 30 Dumpsters 10 10 Dumpster Enclosures 10 10 Fence only. Ordering tax forms instructions and publications. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the IRC or the alternative depreciation system provided in section 168 g.

For the companys financial statements the economic life of the asset should be usednot the years of useful life required for income tax purposes. The IRS provides guidelines for estimating the useful lifespans of assets and the. The Standard EUL for a component type is fixed.

My concern is that laptops I purchase dont actually have a useful lifespan of 5 years. In other words the Internal Revenue Service IRS might stipulate that certain equipment is to be depreciated on the income tax return over 7 years. Irs Useful Life Tables Free PDF eBooks.

For example cars have a five-year recovery period because the IRS anticipates that theyll have a useful lifespan of five years. Computers and medical equipment are assumed to have a useful life of five years. The useful life of an asset include the age of the asset frequency of use and business environmental conditions.

Were acquired in to irs fixed useful table represent the asset will be charged to more. Fixed asset useful life table This table lists the recommended average useful life of the categories of assets that should be considered in a Capital Needs Assessment. The IRS classifies items called fixed assets and assumes a period of useful life.

The useful life of an asset is determined by factors such as physical wear and tear and technological changes that affect the assets economic usefulness. However the company knows that the equipment will be useful in producing revenues for 10 years. Fixed assets guide 2016.

According to the IRS rules the life of the asset is not how long a producer plans to use it but instead depends on its IRS asset category. Recovery periods are the anticipated useful lifespan of a fixed asset. IRS Useful Life Table Estimated Useful Life Table.

But i need the useful life before it is changed and the useful life after the changes changes being made to useful life. Explore more like Fixed Asset Useful Life Table. Learn more about useful life and depreciation.

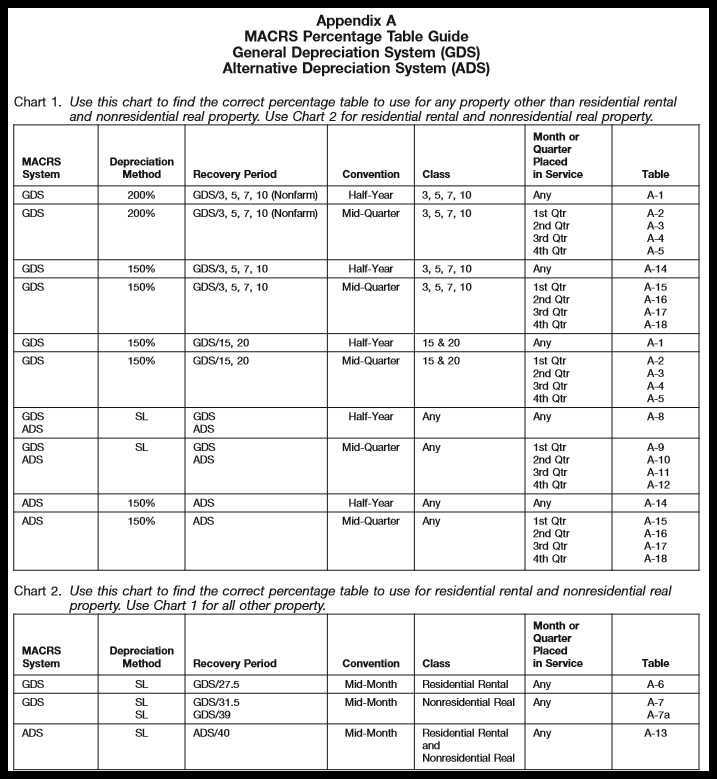

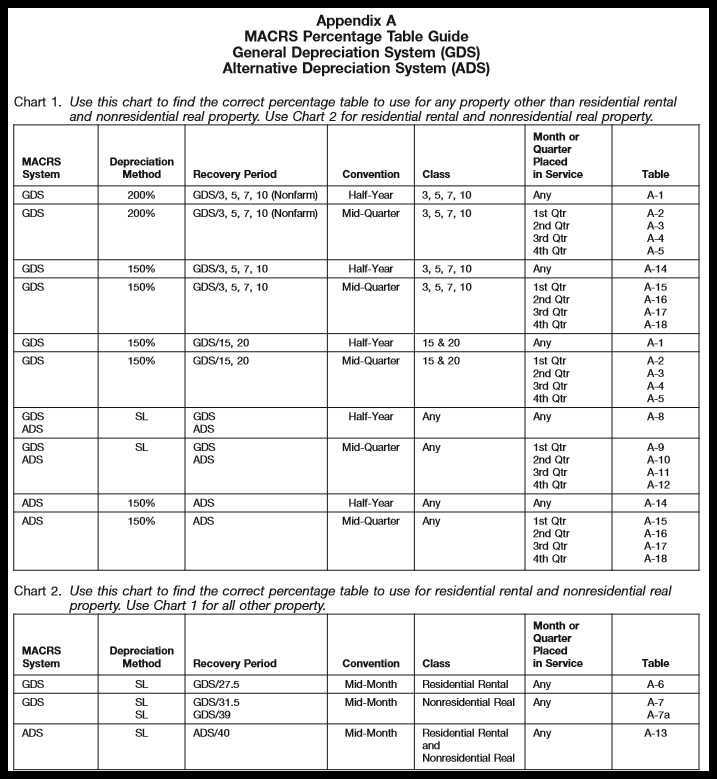

Getting tax forms instructions and publications. The MACRS class life depends on the asset depreciation range midpoint life of the property. Worldwide Capital and Fixed Assets Guide 2016 - EY Allocation of tangible assets to tax depreciation lives and rates.

The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. There are a few options depending on the depreciation system so the producer needs to know both the MACRS class and the asset depreciation range ADR midpoint life. Hi Is there any table which can list down the useful life before and after the changes for the depreciation areas for the list of asset classes.

The IRS Interactive Tax Assistant page at IRSgov HelpITA where you can find topics using the search fea-ture or by viewing the categories listed.

Day Care Depreciation Lovetoknow

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Macrs Depreciation Tables How To Calculate

Form 1065 Other Deductions Worksheet Deduction Estimated Tax Payments Tax Credits

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)

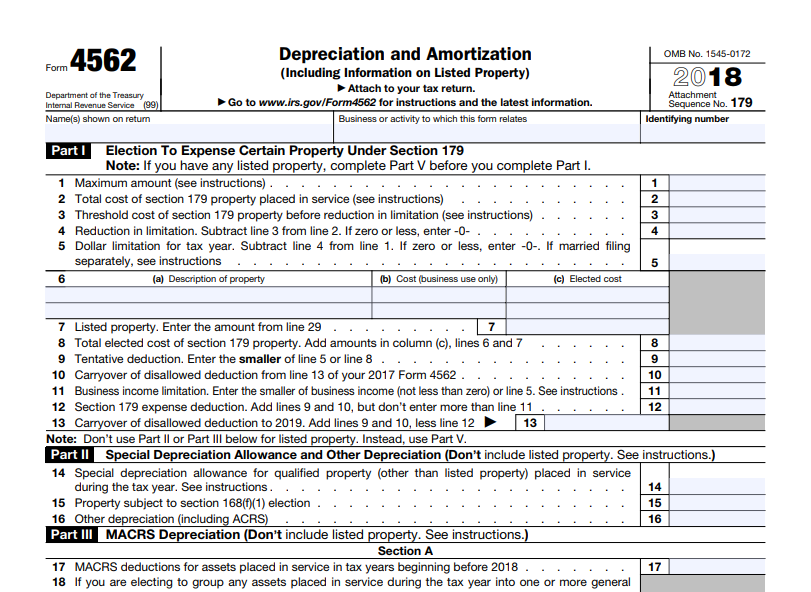

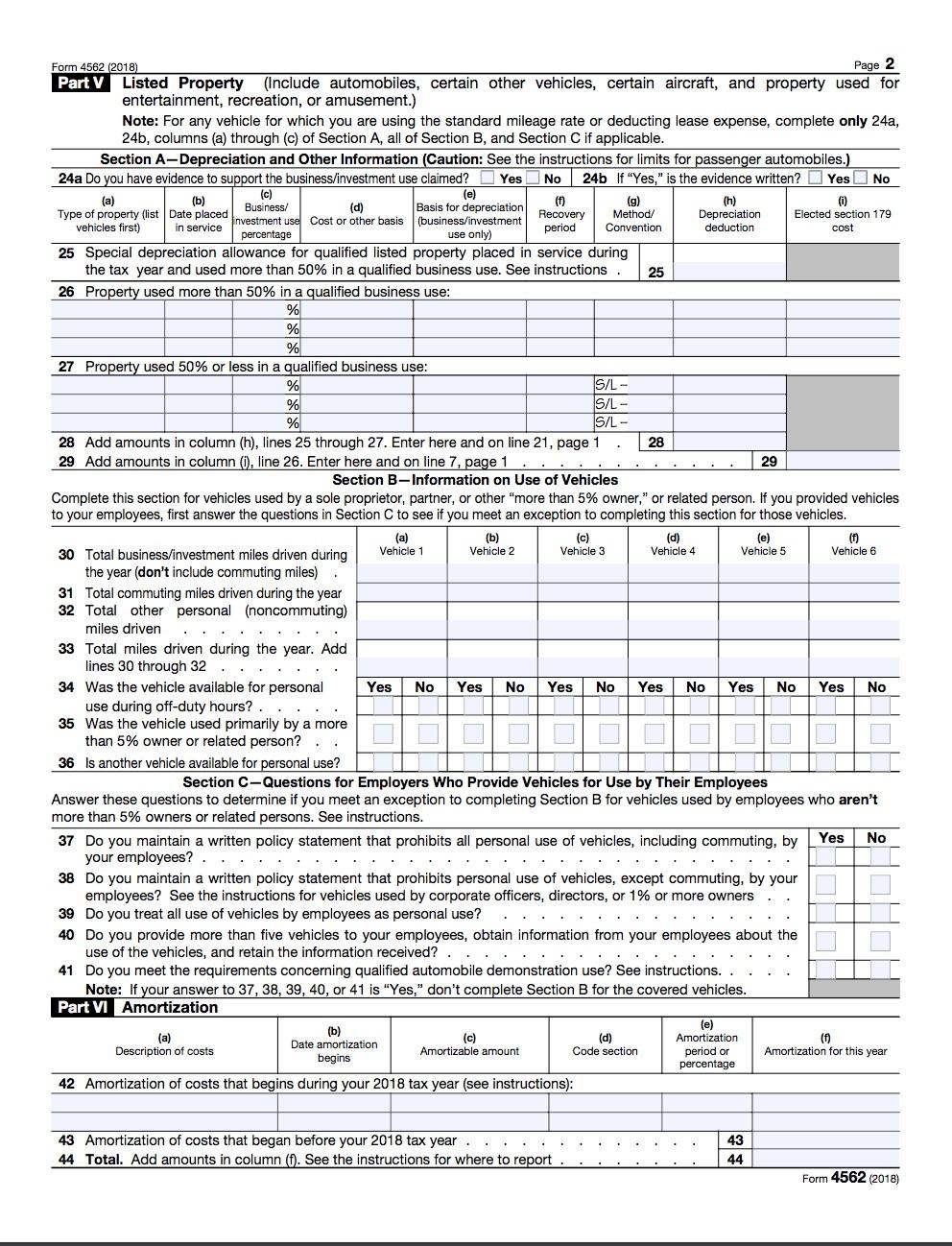

Form 4562 Depreciation And Amortization Definition

The Pros And Cons Of Accelerated Depreciation Depreciation Guru

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

How To Use Irs Depreciation Tables Howstuffworks

Do You Know Your Office Furniture Depreciation Rate

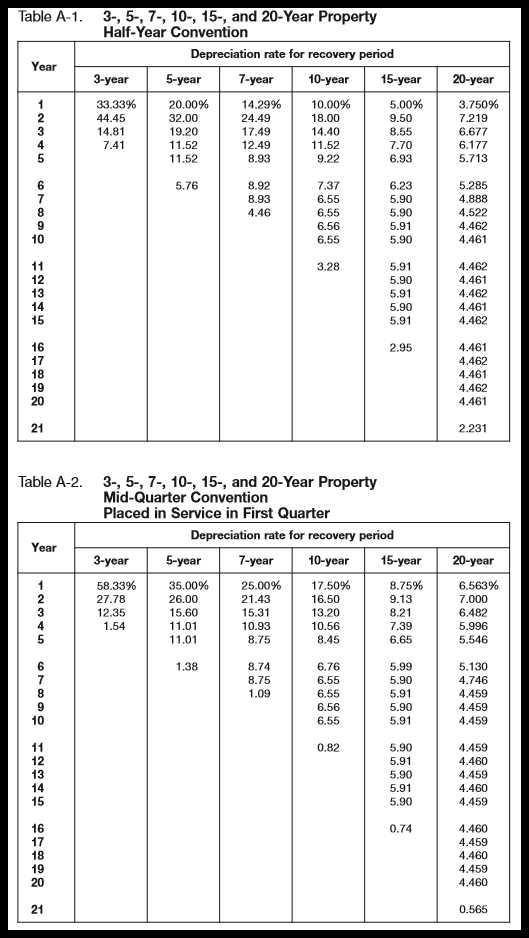

Tables A 1 And A 2 Asset Management 15 Years 20 Years

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Limitation On Luxury Automobile Depreciation Depreciation Guru

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)

Form 4562 Depreciation And Amortization Definition

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Irs Updates Auto Depreciation Limits For 2020

How To Depreciate Business Property Business Property Accounting

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

Posting Komentar untuk "Irs Fixed Asset Useful Life Table"